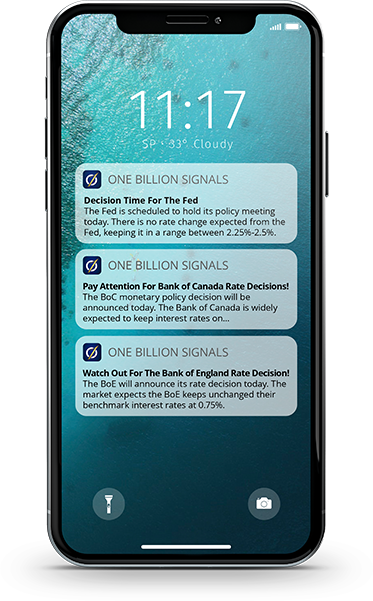

When it comes to trading it's important to catch the right moment. We provide push notifications on live trading signals, market news and sophisticated technical analyses to help you be on time – and profit from it.

Don't worry if you accidentally cleared your screen or missed one of our push notifications. Go to the Active Signals tab and you'll see a list of all currently active trading signals. Tap on each signal to reveal a deeper technical analysis.

Our experienced team of market analysts monitors the market daily and identifies trading opportunities by analyzing statistical trends gathered from trading activity. We deliver our market insights in the form of short reports that help you analyze trends without wasting your time.

Financial markets are influenced by economics, politics, public affairs, and many other factors. It's crucial to stay up-to-date on current and expected events if you want to be a profitable investor. Visit our Market News tab to stay on top of trends!

We believe in convenience and quick decisions. We support and deliver signals for 65 instruments, including forex pairs, indices, commodities, cryptocurrencies... you name it. We keep expanding the list so we can be your trusted one-stop shop!

The Performance tab gathers all signals in one place. It helps you track their performance in chronological order.

Instant Notifications

When it comes to trading it's important to catch the right moment. We provide push notifications on live trading signals, market news and sophisticated technical analyses to help you be on time – and profit from it.

Active Signals

Don't worry if you accidentally cleared your screen or missed one of our push notifications. Go to the Active Signals tab and you'll see a list of all currently active trading signals. Tap on each signal to reveal a deeper technical analysis.

Technical Analyses

Our experienced team of market analysts monitors the market daily and identifies trading opportunities by analyzing statistical trends gathered from trading activity. We deliver our market insights in the form of short reports that help you analyze trends without wasting your time.

Market News

Financial markets are influenced by economics, politics, public affairs, and many other factors. It's crucial to stay up-to-date on current and expected events if you want to be a profitable investor. Visit our Market News tab to stay on top of trends!

Instrument Profile

We believe in convenience and quick decisions. We support and deliver signals for 65 instruments, including forex pairs, indices, commodities, cryptocurrencies... you name it. We keep expanding the list so we can be your trusted one-stop shop!

Performance

The Performance tab gathers all signals in one place. It helps you track their performance in chronological order.

Our experienced team follows market movements and performs daily analyses to deliver live signals for your next investment move. We also provide our VIP customers with coaching, live-streamed trading sessions, one-to-one meetings and 24/7 support.

All you need - in your pocket. With One Billion Signals, we really aimed to put everything a trader needs in one place.

OneBillionSignalsPro is a revolutionary leader in fintech with its Copy Trading Platform. Choose the instruments you want to copy with your broker.

Risk Warning

Important : One Billion Signals will not be liable for any losses sustained while using the services provided on the One Billion Signals application. This application is not a solicitation to trade forex signals, nor is the representation is being made that any account will, or is likely to, achieve profits or losses similar to those discussed on the application. The past performance of any trading system or methodology is not necessarily indicative of future results.

© 2024 One Billion Signals All Rights Reserved